Can Intel (INTC)’s New CEO Turn Things Around?

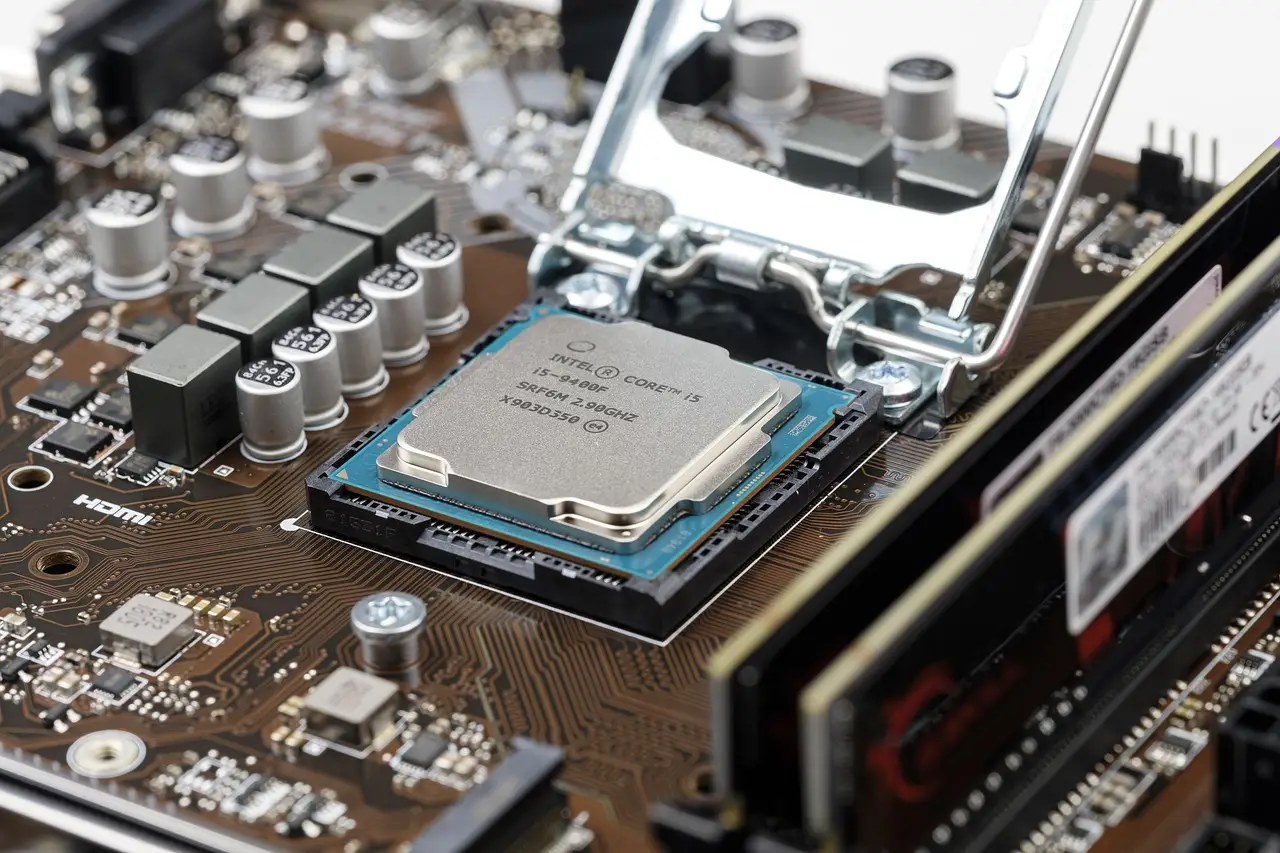

[Image: Pixabay – StockSnap]

Introduction

Intel’s new CEO, Lip-Bu Tan, recently outlined his strategy to revive the struggling chip giant—but Wall Street isn’t fully convinced. The stock dropped 2.9% after his speech, reflecting skepticism over whether Intel can execute a turnaround. With fierce competition from AMD, NVIDIA, and TSMC, can Tan’s “startup mentality” really fix Intel’s deep-rooted problems?

[Image: Pixabay – Bru-nO]

What’s Happening at Intel

Tan’s vision focuses on culture change, customer collaboration, and advanced chip manufacturing (18A process). However, we at Bold Prime remain cautious, noting that fixing Intel’s bureaucracy and product delays won’t happen overnight. Bernstein’s Stacy Rasgon called the speech an “apology” rather than a solid plan, while Truist Securities praised Tan’s tone but maintained a Hold rating. The biggest near-term risk? Weak execution on 18A production—if Intel falls behind schedule again, the stock could face another sell-off.

Forecast for INTC This Week (March 31 – April 4, 2025)

- Current Price: $22.05 (after 2.9% drop post-announcement).

- Key Resistance: $23 (previous support, now resistance).

- Key Support: 21.50 (break down could lead to 20).

- Market Sentiment: Neutral-to-bearish until clearer execution signs emerge.

- Expected Range: 20.50 − 23.50 (volatility likely).

Short-term swings are the best opportunity. A break below 21.50 could signal further downside, making short positions attractive with a target near 20. Conversely, if INTC rebounds above 23, a quick long trade toward 24 may be viable—though caution is advised due to Intel’s unpredictable earnings and macro risks. Always use tight stops (e.g., 2-3% risk) to manage volatility.

[Pixabay – Bru-nO]

Conclusion

Intel’s turnaround is a long-term story, but this week’s price action will depend on market sentiment and technical levels. You should watch support resistance at 21.50 for breakout opportunities, while long-term investors need patience to see if Tan’s strategy delivers. Until then, you can capitalize on volatility—but with disciplined risk management.

Our platform is full of tools and resources for traders such as webinars, blogs, economic calendar and trading education. If you’re new to trading and would want to explore thoroughly, consider using CopyTrade – you can mimic and follow the strategies, plans and movements of the expert traders and gain profits instantly.

Trade smart, trade Bold Prime.